Culture and stock market volatility

There are 2 versions of this paper. This paper examines the impact of national culture on herding behaviour across international financial markets.

Culture and Corporate Governance - Güler Aras - Google Livres

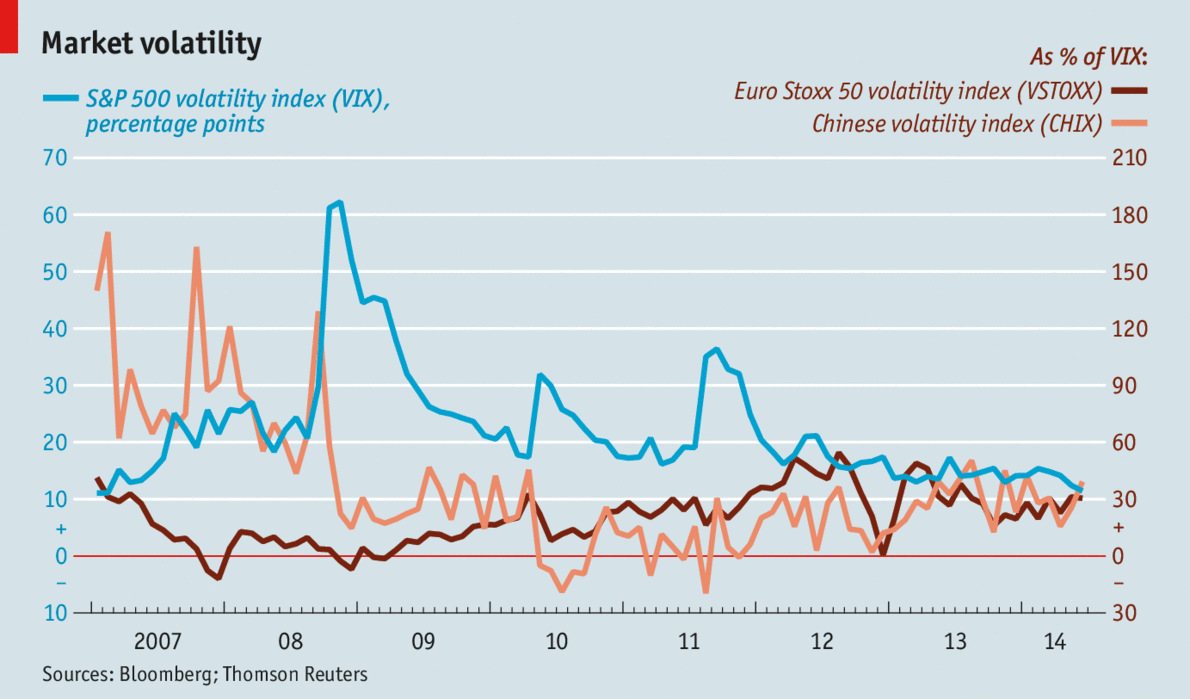

The relation between national culture and investor behaviour, and how it impacts overall market volatility is studied by examining synchronized stock price movements and stock market volatility in 47 countries around the world over the period of January to May I find that Nations with lower value of individualistic culture are more likely to have a higher number of synchronized stock price movements.

Further, the correlations between stock price movements apparently increase stock market volatility. Nations with high individualistic culture have a lower number of synchronized stock price movements and thus have lower levels of stock market volatility.

The positive relationship between synchronized stock price movements and stock market volatility is stronger for emerging markets during the financial crisis from June to December The results are statistically significant regardless of the empirical methods and control variables. Information and market efficiency, International financial markets, Financial economics, Herding, Behavioral finance, Market volatility.

Zhan, Feng, Individualism, Synchronized Stock Price Movements, and Stock Market Volatility January 12, Subscribe to this free journal for more curated articles on this topic. Subscribe to this fee journal for more curated articles on this topic.

Stock Market Volatility - Google Livres

Bankruptcy Codes and Innovation. By Viral Acharya and Krishnamurthy Subramanian. Creditor Rights and Corporate Risk-Taking.

By Viral Acharya , Yakov Amihud , Access to Collateral and Corporate Debt Structure: Evidence from a Natural Experiment. Growing Out of Trouble? Corporate Responses to Liability Risk. By Todd Gormley and David Matsa. Bank Finance Versus Bond Finance. By Fiorella De Fiore and Harald Uhlig.

Cookies are used by this site. To decline or learn more, visit our Cookies page. This page was processed by apollo5 in 0. Your Account User Home Personal Info Affiliations Subscriptions My Papers My Briefcase Sign out. Download this Paper Open PDF in Browser Share: Using the URL or DOI link below will ensure access to this page indefinitely.

Feng Zhan John Carroll University - Boler School of Business. Individualism, Synchronized Stock Price Movements, and Stock Market Volatility Number of pages: You are currently viewing this paper.

U.S. Stock Market Data - Dow Jones, Nasdaq, S&P - CNNMoney

Abstract This paper examines the impact of national culture on herding behaviour across international financial markets. Feng Zhan Contact Author John Carroll University - Boler School of Business email University Heights, OH United States. Download this Paper Open PDF in Browser. Recommended Papers Bankruptcy Codes and Innovation By Viral Acharya and Krishnamurthy Subramanian Creditor Rights and Corporate Risk-Taking By Viral Acharya , Yakov Amihud , Creditor Rights and Corporate Risk-Taking By Viral Acharya , Yakov Amihud , Evidence from a Natural Experiment By Vikrant Vig Growing Out of Trouble?

Corporate Responses to Liability Risk By Todd Gormley and David Matsa Bank Finance Versus Bond Finance By Fiorella De Fiore and Harald Uhlig.

Eastern, Monday - Friday. Submit a Paper Section Text Only Pages. Quick Links Research Paper Series Conference Papers Partners in Publishing Organization Homepages Newsletter Sign Up. Rankings Top Papers Top Authors Top Organizations. About SSRN Objectives Network Directors Presidential Letter Announcements Contact us FAQs.

Copyright Terms and Conditions Privacy Policy.