Foreign currency cash flow hedge accounting

May a company treat foreign-currency-denominated fixed-rate interest coupon payments arising from an issuance of foreign-currency-denominated fixed rate debt as a an unrecognized firm commitment that may be designated as a hedged item in a foreign currency fair value hedge or b forecasted transactions that may be designated as hedged transactions in a foreign currency cash flow hedge?

A company whose functional currency is the U. The debt has a fixed interest coupon that is payable semi-annually in that foreign currency.

The company wishes to lock in, in U. For example, the company may enter into a foreign currency swap to receive an amount of the foreign currency required to satisfy the coupon obligation in exchange for U. An agreement with an unrelated party, binding on both parties and usually legally enforceable, with the following characteristics:.

Difference Between Fair Value Hedge and Cash Flow Hedge - IFRSbox

A transaction that is expected to occur for which there is no firm commitment. Because no transaction or event has yet occurred and the transaction or event when it occurs will be at the prevailing market price, a forecasted transaction does not give an entity any present rights to future benefits or a present obligation for future sacrifices.

A company may not treat foreign-currency-denominated fixed-rate interest coupon payments arising from an issuance of foreign-currency-denominated fixed-rate debt as an unrecognized firm commitment that may be designated as a hedged item in a foreign currency fair value hedge.

The foreign-currency exposure of the future interest payments would not meet Statement 's definition of an unrecognized firm commitment because the obligation is recognized on the balance sheet-that is, the carrying amount of the foreign-currency-denominated fixed-rate debt incorporates the entity's obligation to make those future interest payments as well as the repayment of principal.

However, those fixed-rate interest payments could be designated as the hedged transaction in a cash flow hedge. The above guidance also applies to dual-currency bonds that provide for repayment of principal in the functional currency and periodic fixed-rate interest payments denominated in a foreign currency. Thus, those fixed-rate interest payments on a dual-currency bond could be designated as the hedged transaction in a cash flow hedge of foreign exchange risk.

Accounting for Derivatives - FAS

The above response has been authored by the FASB staff and represents the staff's views, although the Board has discussed the above response at a public meeting and chosen not to object to dissemination of that response.

Official positions of the FASB are determined only after extensive due process and deliberation. FAF FASB GASB RSS Youtube Twitter Linked In.

Foreign exchange hedge - Wikipedia

FASB, Financial Accounting Standards Board. CONTACT US HELP ADVANCED SEARCH. Hedging Foreign-Currency Denominated Interest Payments Derivatives Implementation Group Statement Implementation Issue No. Hedging Foreign-Currency Denominated Interest Payments Paragraph references: July 28, Affected by: Paragraph 37 of Statement states: A derivative instrument or a nonderivative financial instrument that may give rise to a foreign currency transaction gain or loss under Statement 52 can be designated as hedging changes in the fair value of an unrecognized firm commitment, or a specific portion thereof, attributable to foreign currency exchange rates.

The designated hedging relationship qualifies for the accounting specified in paragraphs if all the fair value hedge criteria in paragraphs 20 and 21 and the conditions in paragraphs 40 a and 40 b are met. A derivative instrument designated as hedging the foreign currency exposure to variability in the functional-currency-equivalent cash flows associated with a forecasted transaction…, a recognized asset or liability, an unrecognized firm commitment, or a forecasted intercompany transaction…qualifies for hedge accounting if all of the following criteria are met: For consolidated financial statements, either 1 the operating unit that has the foreign currency exposure is a party to the hedging instrument or 2 another member of the consolidated group that has the same functional currency as that operating unit subject to the restrictions in this subparagraph and related footnote is a party to the hedging instrument.

To qualify for applying the guidance in 2 above, there may be no intervening subsidiary with a different functional currency. Refer to paragraphs 36, 40A, and 40B for conditions for which an intercompany foreign currency derivative can be the hedging instrument in a cash flow hedge of foreign exchange risk.

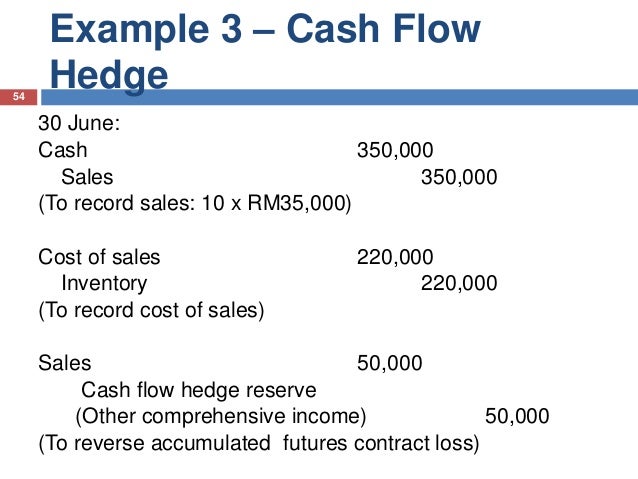

Accounting for Cash Flow Hedge | Journal Entries | Example

All of the criteria in paragraphs 28 and 29 are met, except for the criterion in paragraph 29 c that requires that the forecasted transaction be with a party external to the reporting entity. If the hedged transaction is a group of individual forecasted foreign-currency-denominated transactions, a forecasted inflow of a foreign currency and a forecasted outflow of a foreign currency cannot both be included in the same group.

Paragraph of Statement includes the following definitions: Firm commitment An agreement with an unrelated party, binding on both parties and usually legally enforceable, with the following characteristics: The agreement specifies all significant terms, including the quantity to be exchanged, the fixed price, and the timing of the transaction.

The fixed price may be expressed as a specified amount of an entity's functional currency or of a foreign currency. It may also be expressed as a specified interest rate or specified effective yield.

The agreement includes a disincentive for nonperformance that is sufficiently large to make performance probable. Forecasted transaction A transaction that is expected to occur for which there is no firm commitment. RESPONSE A company may not treat foreign-currency-denominated fixed-rate interest coupon payments arising from an issuance of foreign-currency-denominated fixed-rate debt as an unrecognized firm commitment that may be designated as a hedged item in a foreign currency fair value hedge.

Technical Agenda Exposure Documents Comment Letters Recently Completed Projects Technical Inquiry Service. Upcoming Meetings Past FASB Meetings Tentative Board Decisions Meeting Minutes Subscribe to Action Alert Directions, Transportation, Area Hotels. Hedging Foreign-Currency Denominated Interest Payments.