Stock market and gdp correlation

Why is there a correlation between equity returns and aggregate GDP growth but not per capita growth? THE annual report on markets by Elroy Dimson, Paul Marsh and Mike Staunton of the London Business School produced in association with Credit Suisse is always good value and this year's effort is no exception.

Share Market | BSE NSE - Stock Market India News, SENSEX Nifty, Forex & Commodity Market News

The main theme is related to emerging markets and will be the focus of this week's column. But one oddity emerged in the course of the report that it is quite difficult to explain and is worth exploring in more detail.

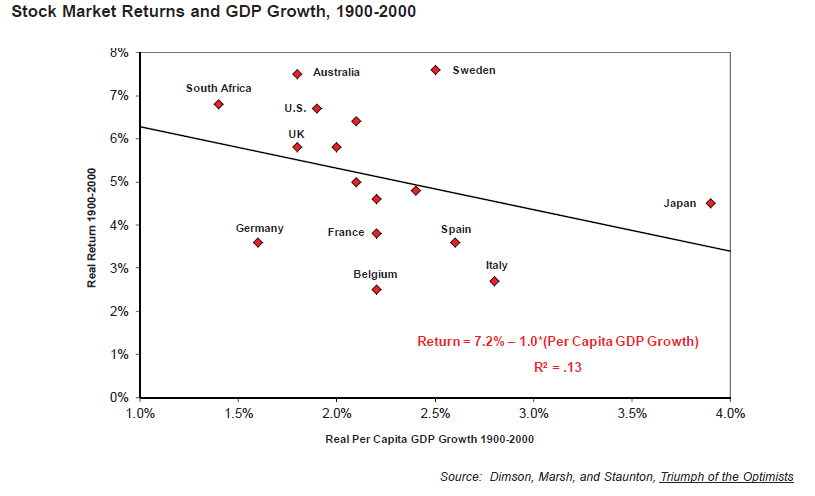

An oft-quoted argument for investing in emerging markets is their superior economic growth. But the professors have pointed out in the past that economic growth and equity returns are not correlated at all.

Jay Ritter of the University of Florida has a paper on the same issue. If this lack of relationship seems odd, the professors' argument is more subtle; yes, it would be useful to be aware of future economic growth. But being aware of past economic growth does not help; or rather, it is a a contrary indicator. You would be best placed investing in the slower-growing economies of the past, not in the fastest.

This may well be a value effect; stocks in fast-growing economies get bid up in price price-earnings ratios go up and dividend yields go down while the opposite occurs in the slow growers. A shame this hedge fund didn't spot this simple rule.

Little Relationship Between Stocks, GDP - Business Insider

It would help investors to know which economies will grow fastest in the future but of course investors don't know this; the academics have a wonderful scatter chart showing the lack of correlation between growth rates in one year and the year after next.

But now for the puzzle. Over the long run , there is actually a negative correlation But there is a positive correlation between aggregate real GDP growth and real equity returns 0. Why the big difference? Of course, the gap between aggregate and per capita growth is explained by population movements. South Africa's aggregate GDP has grown faster than Ireland's but more than half of this is accounted for by a bigger population; Ireland's population has risen very slowly thanks to periods of emigration so almost all its economic growth is per capita.

The professors use the analogy of equity issuance; as countries grow their stockmarkets get bigger as more companies float and more shares are issued. In theory, profits might double but if share issuance doubles, investors will be no better off.

But this analogy seems the wrong way round. Correlation is not causation but the statistical relationship shows that investors do better when the population is rising and pushing up GDP than when productivity growth alone is pushing up GDP. If growth is being shared out between more people, why do investors get a bigger chunk?

Is it because a bigger population thanks to immigration or a high birth rate increases the sze of the workforce, drives down real wages, and increases the return to capital? Going forward, we know that population growth will be sluggish in the developed world so aggregate GDP will rise slowly. Will this be bad news for equities? The Japanese have done quite well in terms of GDP per capita in the last 20 years but not so well in aggregate terms.

And their stockmarket is still less than half its peak.

Media Audio edition Economist Films Economist Radio The Economist apps. Other Publications Magazine The World In The World If. Media Audio edition Economist Films Economist Radio.

From The Economist Group Events Jobs Board Which MBA Executive Education Navigator Online GMAT prep Online GRE prep Learning. Register now Activate your digital subscription Manage your subscription Renew your subscription.

Latest updates Leaders Briefing United States The Americas Asia China Middle East and Africa Europe Britain International Business Finance and economics Science and technology Books and arts Obituary Special report Technology Quarterly Debates. The Economist apps Espresso Global Business Review World in Figures Events Jobs Board Which MBA Executive Education Navigator Online GMAT prep Online GRE prep Learning.

Growth and markets A puzzling discrepancy Why is there a correlation between equity returns and aggregate GDP growth but not per capita growth? What do election observers do? The Economist explains 3 hours ago. A new Supreme Court case could rejigger electoral lines for the election. Democracy in America 15 hours ago.

Americas 16 hours ago. The number of forcibly displaced people grew to a record in Graphic detail 16 hours ago.

The outrageous death of Otto Warmbier.

Stock Market Returns - The GDP Growth Rate Myth - Articles - Advisor Perspectives

Asia 17 hours ago. Prospero 17 hours ago. Another victim The outrageous death of Otto Warmbier A travel ban for American citizens to North Korea may be in the offing.

Northern pilot Finland tests an unconditional basic income. Trade policy How Chinese overcapacity hits American workers. The Economist explains What do election observers do? Tell us what you think of Economist.

Need assistance with your subscription? Subscribe Contact us Help.

Site-By-Site! The International Investment Portal & Research Center

Keep updated facebook icon twitter icon googleplus icon linkedin icon tumblr icon instagram icon youtube icon rss icon mail icon Subscribe to The Economist newsletters. Advertise Reprints Careers Media Centre. Terms of Use Privacy Cookies Accessibility Modern Slavery Statement.