Call option price approximation

I understand that "computationally simpler" is not well-defined. But I mean simpler in terms of number of terms used in the function.

Or even more specifically, the number of distinct computational steps that needs to be completed to arrive at the Black-Scholes output. This is just to expand a bit on vonjd's answer.

The approximate formula mentioned by vonjd is due to Brenner and Subrahmanyam "A simple solution to compute the Implied Standard Deviation", Financial Analysts Journal , pp. I do not have a free link to the paper so let me just give a quick and dirty derivation here.

If you hate computers and computer languages don't give up it's still hope! What about taking Black-Scholes in your head instead? If the option is about at-the-money-forward and it is a short time to maturity then you can use the following approximation:.

In addition to what vonjd already posted I would recommend you to look at the E. Haug's article - The Options Genius. You can find some aproximations of BS not only for vanilla european call and put but even for some exotics. The Black-Scholes 'normal-vol' formula leads quickly to a similar approximation to the one described by olaker.

Saddlepoint approximations to option price in a regime-switching model | SpringerLink

Click here for a paper which contains a formal derivation of the call and put prices based on a normal model ie a brownian motion rather than a geometric brownian motion. I have recently discovered a generalization of this formula which works very well for strikes which are not at the money too. See my blog for a longer discussion, here are the main points. As I say, have a look in a spreadsheet.

Nonetheless, this simple-but-wrong formula for the Call Price points us in the right direction: So far this is just a rearrangement of the original Black-Scholes 'normal-vol' formula. You can use this Hardy Decomposition to calculate option prices in your head - you only need to remember a few values:. As other people have said, you need to approximate the cumulative.

The problem is that wherever you look you will find that to approximate it you will need to use exponentials or trigonometric functions which are also very expensive. What you can do is to build yourself a cubic spline with pre-cached values for the cumulative and calculate the value at other points x by cubic interpolation. That will make it much faster. Possibly you will also call this method with a series of ordered values so that you can avoid doing the binary search to locate the interval.

You will have a cached index for the last interval located and look around that one.

By posting your answer, you agree to the privacy policy and terms of service. By subscribing, you agree to the privacy policy and terms of service. Sign up or log in to customize your list.

Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top.

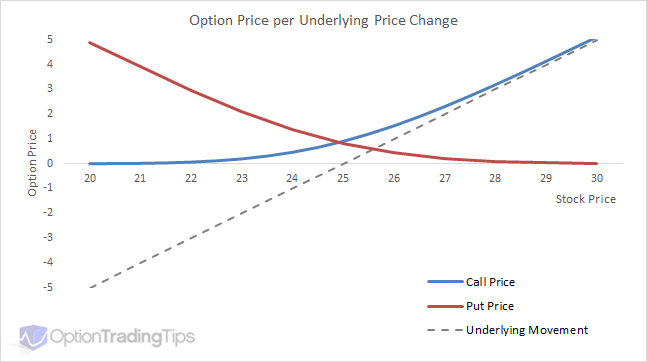

What are some useful approximations to the Black-Scholes formula? Does any such simpler approximations exist? I wonder if there are any approximations for options that are not at the money? Anyone got anything better? This one is the best approximation I have ever seen: If the option is about at-the-money-forward and it is a short time to maturity then you can use the following approximation: Andrey Taptunov 1, 15 The formula for the call price is: Options which are not ATM I have recently discovered a generalization of this formula which works very well for strikes which are not at the money too.

The standard decomposition for an option is: Consequently, the BS normal formula is almost: Here is my solution. I call it The Hardy Decomposition: You can use this Hardy Decomposition to calculate option prices in your head - you only need to remember a few values: Robert 4 6.

Sign up or log in StackExchange. Sign up using Facebook.

Straddle Approximation Formula | Brilliant Math & Science Wiki

Sign up using Email and Password. Post as a guest Name. In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers.

Quantitative Finance Stack Exchange works best with JavaScript enabled. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.