Current controversies surrounding stock options

The question of whether or not to expense options has been around for as long as companies have been using options as a form of compensation. But the debate really heated up in the wake of the dotcom bust. This article will look at the debate and propose a solution. Before we discuss the debate, we need to review what options are and why they are used as a form of compensation. To learn more about the debate on options payouts, see The Controversy Over Option Compensations.

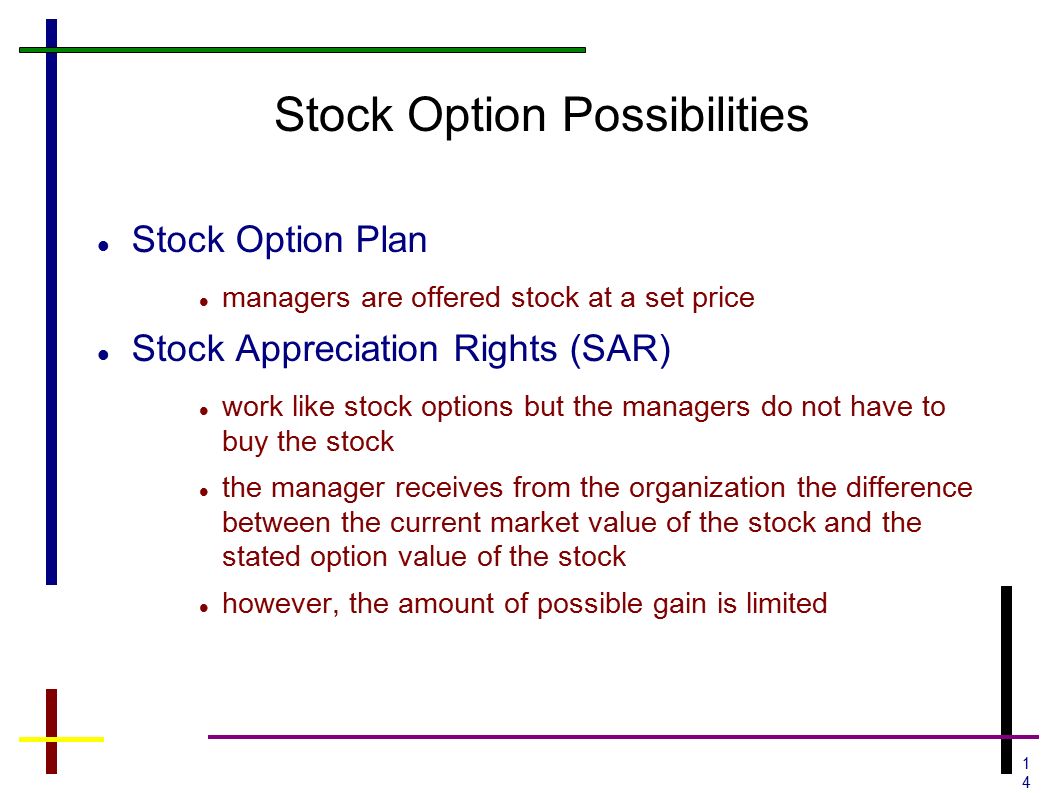

Why Options Are Used as Compensation Using options instead of cash to pay employees is an attempt to "better align" the interests of the managers with those of the shareholders. Using options is supposed to prevent management from maximizing short-term gains at the expense of the long-term survival of the company. Managements are tempted to postpone these costs to help them make their quarterly profit targets. As a result, managers still receive their bonus pay even though the company's stock is falling.

Clearly, this type of bonus program is not in the best interest of the shareholders who invested in the company for long-term capital appreciation. Using options instead of cash is supposed to incite the executives to work so the company achieves long-term earnings growth, which should, in turn, maximize the value of their own stock options. How Options Became Headline News Prior to , the debate over whether or not options should be expensed on the income statement was limited mostly to academic discussions for two main reasons: Option awards were limited to "C-level" CEO , CFO , COO , etc.

The relatively small number of people in such programs minimized the size of the impact on the income statement , which also minimized the perceived importance of the debate. The second reason there was limited debate is that it requires knowing how esoteric mathematical models valued options. Option pricing models require many assumptions, which can all change over time. Because of their complexity and high level of variability, options cannot be explained adequately in a second soundbite which is mandatory for major news companies.

Accounting standards do not specify which option-pricing model should be used, but the most widely used is the Black-Scholes option-pricing model. Take advantage of stock movements by getting to know these derivatives Understanding Option Pricing. Everything changed in the mids.

Why Facebook Inc's Stock Target Was Raised (FB) | InvestorPlace

The use of options exploded as all types of companies began using them as a way to finance growth. The dotcoms were the most blatant users abusers? Dotcom workers sold their souls for options as they worked slave hours with the expectation of making their fortunes when their employer became a publicly-traded company.

Option use spread to non-tech companies because they had to use options in order to hire the talent they wanted. Eventually, options became a required part of a worker's compensation package. By the end of the s, it seemed everyone had options. But the debate remained academic as long as everyone was making money.

The complicated valuation models kept the business media at bay. Then everything changed, again. The dotcom crash witch-hunt made the debate headline news. The fact that millions of workers were suffering from not only unemployment but also worthless options was widely broadcast.

The media focus intensified with the discovery of the difference between executive option plans and those offered to the rank and file. C-level plans were often re-priced, which let CEOs off the hook for making bad decisions and apparently allowed them more freedom to sell.

The plans granted to other employees did not come with these privileges. This unequal treatment provided good soundbites for the evening news, and the debate took center stage.

The Impact on EPS Drives the Debate Both tech and non-tech firms have increasingly used options instead of cash to pay employees. Expensing options significantly affect EPS in two ways.

The Controversy Over Option Expensing

First, as of , it increases expenses because GAAP requires stock options to be expensed. Second, it reduces taxes because companies are allowed to deduct this expense for tax purposes which can actually be higher than the amount on the books. Learn more in our Employee Stock Option Tutorial.

The Debate Centers on the "Value" of the Options The debate over whether or not to expense options centers on their value. Fundamental accounting requires that expenses be matched with the revenues they generate. No one argues with the theory that options, if they are part of compensation, should be expensed when earned by employees vested. But how to determine the value to be expensed is open to debate.

At the core of the debate are two issues: The main value argument is that, because options are difficult to value, they should not be expensed. The numerous and constantly changing assumptions in the models do not provide fixed values that can be expensed.

It is argued that using constantly changing numbers to represent one expense would result in a " mark-to-market " expense that would wreck havoc with EPS and only further confuse investors.

This article focuses on fair value. The value debate also hinges on whether to use " intrinsic " or "fair" value. The other component of the argument against expensing options looks at the difficulty of determining when the value is actually received by the employees: When it gave you the right, or when it had to pay up?

For more, read A New Approach To Equity Compensation. These are difficult questions, and the debate will be ongoing as politicians try to understand the intricacies of the issues while making sure they generate good headlines for their re-election campaigns.

Eliminating options and directly awarding stock can resolve everything. This would eliminate the value debate and do a better job of aligning management interests with those of the common shareholders. Because options are not stock and can be re-priced if necessary, they have done more to entice managements to gamble than to think like shareholders. The Bottom Line The current debate clouds the key issue of how to make executives more accountable for their decisions.

Using stock awards instead of options would eliminate the option for executives to gamble and later re-price the options , and it would provide a solid price to expense the cost of the shares on the day of the award. It would also make it easier for investors to understand the impact on both net income as well as shares outstanding.

To learn more, see The Dangers Of Options Backdating , The "True" Cost Of Stock Options. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

The Controversy Over Option Expensing By Rick Wayman Share. Options Basics Why Options Are Used as Compensation Using options instead of cash to pay employees is an attempt to "better align" the interests of the managers with those of the shareholders. Perhaps the real cost of employee stock options is already accounted for in the expense of buyback programs.

The pros and cons of corporate stock options have been debated since the incentive was created. Learn more about stock option basics and the cost of stock options. Options are valued in a variety of different ways.

Learn about how options are priced with this tutorial. Futures contracts are available for all sorts of financial products, from equity indexes to precious metals. Trading options based on futures means buying call or put options based on the direction Trading options is not easy and should only be done under the guidance of a professional. Understand how options may be used in both bullish and bearish markets, and learn the basics of options pricing and certain Learn about investing in put options and the associated risks.

Explore how options can provide risk, which is precisely defined Before learning about exotic options, you should have a fairly good understanding of regular options.

Both types of options Learn how the strike prices for call and put options work, and understand how different types of options can be exercised Learn about the difficulty of trading both call and put options. Explore how put options earn profits with underlying assets An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.