Stock options taxes capital gains

Non-Qualified Stock Options - TurboTax Tax Tips & Videos

Book an Appointment A CPA will be in touch with you ASAP. I'd like to receive occasional accounting tips by email.

Please leave this field empty. Home Our Process Our Services Our Customers Our Team Blog Press Contact Us How are stock options taxed?

November 21, - 5 minute read Josh Zweig When cash reserves are low but growth potential is high, startups may decide to issue stock options, sometimes in lieu of higher salaries. Stacey was not issued any actual company stock and was only issued an option to acquire the stock at a later date.

Long-Term Capital Gains Tax Rates in -- The Motley Fool

When the 2 year waiting or vesting period is up, Stacey decides to use or exercise her options. The following year, the founders announce that StartUp Co.

Her employer will include the amount on her T4 and it will be added to her total taxable salary on her personal tax return. This difference between the amount her shares were worth when she exercised her options and the sales price on the exit is a capital gain.

Get The Most Out Of Employee Stock Options

While many startups in Canada will qualify as a CCPC, keep in mind that there are different rules for non-CCPCs and public companies — which would have a separate set of tax implications when issuing stock options.

Home Our Process Our Services Our Customers Our Team Blog Press Contact Us. How are stock options taxed?

November 21, - 5 minute read. When cash reserves are low but growth potential is high, startups may decide to issue stock options, sometimes in lieu of higher salaries.

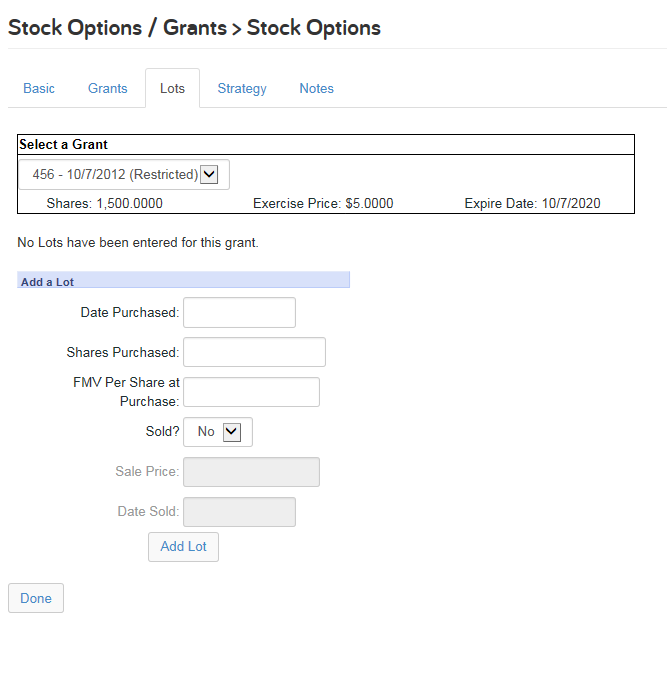

So when does Stacey pay any tax? The tax treatment for a CCPC stock option plan When the 2 year waiting or vesting period is up, Stacey decides to use or exercise her options.

Thinking of moving your systems online?

Book a complimentary call with us, and learn how we can work together to simplify your workflow. Pin It on Pinterest.