Currency futures options and swaps

Derivatives are products, instruments, or securities which are derived from another security, cash market, index, or another derivative.

The base is referred to as the benchmark. By establishing the benchmark, one can try to evaluate the related derivatives.

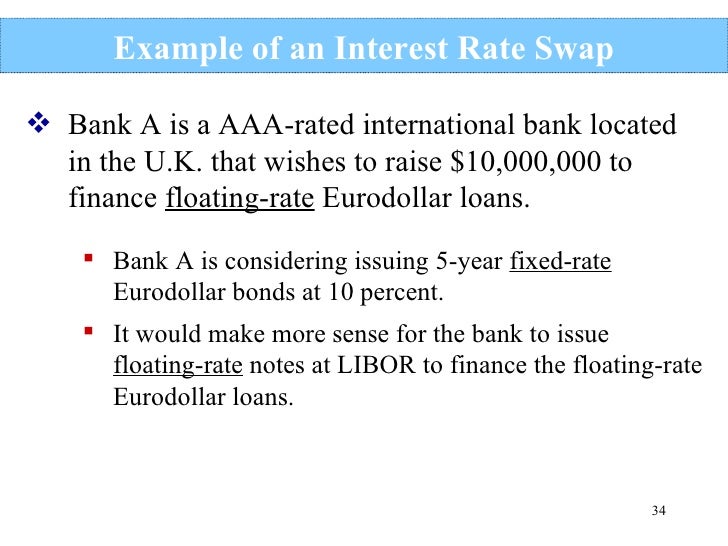

An Introduction To Swaps

For more information, this online site contains many references for Derivatives. The following list highlights some of these references.

Some common derivatives are: Sometimes, derivatives are called "Contingent Claims" because they are dependent on variables which influence the valuation process. For example, in currencies, there is a cash or spot forex market, a bank forward market, a currency futures market, options on actual or cash currencies, options on currency futures, swaps on currencies, instruments on stocks or shares ADRsoptions on swaps swaptions and so on.

Some of the defining elements are: Exactly, What is the base?

Currency Futures, Options & Swaps

Currency futures options and swaps happens upon termination or exercise? Is it a standardized, exchange traded product?

Or, currency futures options and swaps it an over-the-counter OTC instrument? Derivatives are used for risk management, investing, and speculative purposes.

Important institutional users are: Often derivative instruments are used to adjust the risk exposures or profiles of actual or cash securities. Therefore, the firm may sell municipal bond futures against it long muni bond inventory, purchase puts against its long treasury position, sell calls against a basket options futures and other derivatives 8th edition solutions manual download corporate bonds portfoliosell forwards or TBAs to be announced mortgage backed instruments against mortgages jam kerja trading forex mortgage backed securities, and swap out of floating rate exposures into fixed rate obligations.

One key reason for the existence of derivatives is to modify risk exposures by creating instruments which directly offset or hedge a position or indirectly, but acceptably, offset a position cross-hedge. Another reason for derivatives is that they serve as proxies for offsetting market values or unacceptable options characteristics.

Derivative (finance) - Wikipedia

Also, some securities may be difficult to borrow in order to implement a risk management short sale. At such times, derivatives can be valuable alternatives.

One group of popular derivatives for individuals and institutions alike are OPTIONS: Risk Management and Analysis Software for Derivatives.

Financial and Derivatives Glossary for Terms and Strategies. Our Mission About Barkley International Inc. Last Modified on Wednesday, June 21,