How to exercise a call option early

This page sets out some typical rules which are employed in the early exercise of an option. However this is not to be construed as advice in any specific case, and you should seek your own independent advice before making any decisions.

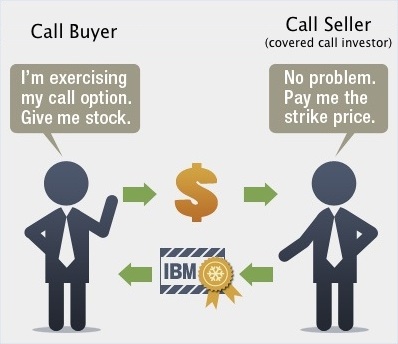

The following table sets out the rule of thumb for when an American call option is likely to be exercised ahead of expiry, before the stock goes ex-dividend. Where a call option is deep-in-the-money, with little chance of the stock falling below the strike price before expiry, the option is a candidate for early exercise.

This generally occurs where the dividend the investor would receive, if they were to exercise the call, is greater than the interest expense incurred in buying the shares which are the subject of the option ahead of the expiry date. Generally this only occurs on the day before the ex-dividend date.

For in-the-money calls where the corresponding put still has some value, the rule used by most of the market is that if the value of the dividend is more than the value of the corresponding put plus interest, then the call should generally be exercised for the dividend. Writers of call options who want to avoid assignment being exercised against may need to either buy back or roll that short call position to another strike in another expiry, being mindful again that the option they roll to is not also a candidate for early exercise.

June Call deep-in-the-money. Therefore the June call will generally be exercised 3. The following table sets out the rule of thumb for when an in-the-money American put option is likely to be exercised ahead of expiry.

When put options are deep-in-the-money they become candidates for early exercise. Consider an how to exercise a call option early where an investor owns both stock and a put option over the same stock, and the put is trading at intrinsic value as is often the case when the option is deep in the money.

By exercising early, the holder of the put sells their shares at the exercise price daftar forex online indonesia the option and earns interest on stock market crash 14000 proceeds earlier than if they were to wait until expiry to exercise.

This usually occurs after how to exercise a call option early stock has gone ex-dividend, so that the dividend is retained by the shareholder. Another way of looking at whether the put should be exercised early is to compare the value of the corresponding call option with the cost of carrying the underlying stock to expiry.

Bbma forex youtube importance of this relationship is due to the fact that stock ownership plus a long put is an equivalent position to holding a call option with the same strike price and expiry. The two strategies are said to be synthetically equivalent.

When Should You Exercise an Option Early?

It is also the reason that mispricing between call and put options with the same strike and expiry is rarely found. Therefore the put will generally be exercised early.

The ASX Group's pinbar strategy using support and resistance span primary and secondary market services, including capital formation and hedging, trading and price discovery Australian Securities Exchange central counter party risk transfer ASX Clearing Corporation ; and securities settlement for both the equities and fixed income markets ASX Settlement Corporation.

Skip to content googletag. Options Early exercise of options. Products Shares Indices Bonds Hybrid securities ETFs and other ETPs Managed funds Warrants Options About options Benefits and risks Buying options Selling options Trading strategies Types Weekly Options Market making Information for institutional investors Historical options data ETO Crossings Equity Options for Financial Advisers Equity Options for SMSFs Index derivatives Interest rate derivatives Grains derivatives Energy derivatives Market Making Arrangements Early exercise of American calls for dividends.

Early exercise of American puts for interest.

Understanding Early Exercise in Options - sanapidyqel.web.fc2.com

Prices and research Prices Company information Announcements ASX BookBuild Announcements Dividends Upcoming floats ASX 24 reports Codes and descriptors Charting Calculators Find a broker Broker Reports. Products Shares Indices Bonds Hybrid securities ETFs and other ETPs Managed funds Warrants Options Index derivatives Interest rate derivatives Grains derivatives Energy derivatives Market Making Arrangements.

Listings Listing with ASX Debt securities Issuer Services. Education Education centre Sharemarket Game Online Courses Investment and finance newsletter Finance seminars and webinars Research and surveys Glossary MyASX Download brochures Watchlists Investment videos First-time investors. About ASX Corporate overview ASX news Investor relations Careers at ASX Market information Market statistics Advertise with ASX ASX System Status Contact ASX.

Regulation Rules, guidance notes and waivers ASX Compliance ASX regulatory compliance Public consultations Corporate Governance Council.

Terms of use Privacy Accessibility Sitemap Contact ASX ASX Limited ABN 98 View mobile site. Follow us on Twitter Visit us on LinkedIn Subscribe on YouTube.