Stock option pricer

With the SAMCO Option Fair Value Calculator calculate the fair value of call options and put options.

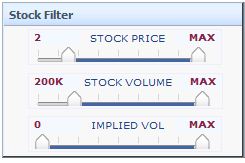

This tool can be used by traders while trading index options Nifty options or stock options. This can also be used to simulate the outcomes of prices of the options in case of change in factors impacting the prices of call options and put options such as changes in volatility or interest rates. A Trader should select the underlying, market price and strike price, transaction and expiry date, rate of interest, implied volatility and the type of option i.

Theoretically, the buyer of a Call option has a RIGHT to BUY the underlying at a pre-determined price. Buyers of call options expect the price of the underlying to appreciate.

Theoretically, Buyers of Call Options can make unlimited profits as stocks can rise to any level, while call option writers make profit limited to the premium received by them.

Black-Scholes Calculator Online | FinTools

The buyer of a Put option has a RIGHT to SELL the underlying at a pre-determined price. Buyers of put options expect the price of the underlying to depreciate. Sellers of a put option have an obligation to TAKE DELIVERY of the underlying at a pre-determined price. Put option writing also requires margin to be paid by the option writer. Theoretically the buyer of the Put option can make a profit limited to the spot price of the underlying less Premium paid, say for example, A Ltd is trading for Rs.

Stock price of A falls to zero, you make a profit of Rs. The profit of the Seller of put options is limited to the premium received by them. Unlike Traditional brokers who charge brokerage per lot purchased or sold, with a Discount Broker like SAMCO, you pay brokerage on the number per transaction!

To put it simply, say you buy 20 lots of call options on the NIFTY in one order. With SAMCO, your brokerage will be Rs. You can calculate your savings with the Brokerage Calculator.

The SAMCO Options Price Calculator is designed for understanding purposes only. It will help users to calculate prices for Nifty options Nifty Option calculator for Nifty Option Trading or Stock options Stock Option Calculator for Stock Option Trading and define their strategies accordingly.

A user should use the output of this calculator at their own risks and consequences and SAMCO would in no way be held responsible for use of the same.

Please click here to go to the login page. Option trading is a highly rewarding way to supercharge your returns! Calculate Fair Values of Call options and Put options for Nifty Options and a wide range of other Index and Stock options listed on the National Stock Exchange in India. In India, options are cash-settled and not settled via actual delivery of the underlying. Why Trade Options with SAMCO?

Option Type Call Put. Stop Paying Per lot brokerage! Open a FREE ACCOUNT.

We have received your request. We will get in touch with you shortly. Email Id already exists in the system. SAMCO Commodities Limited Formerly known as Samruddhi Tradecom India Limited SEBI Reg. South Indian Gymkhana, Bhaudaji Cross Road, Matunga CR, Mumbai — We do not share client details with any third party and do not sell any tips or recommendations. Issued in the interest of investors".

Pricing Options - sanapidyqel.web.fc2.com

Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account. BSE NSE MCX-SX MCX NCDEX SEBI.

Why Us Downloads FAQ's Funds DP Sitemap Blog Account Opening Status Stock Market Updates.