Forex trading notes

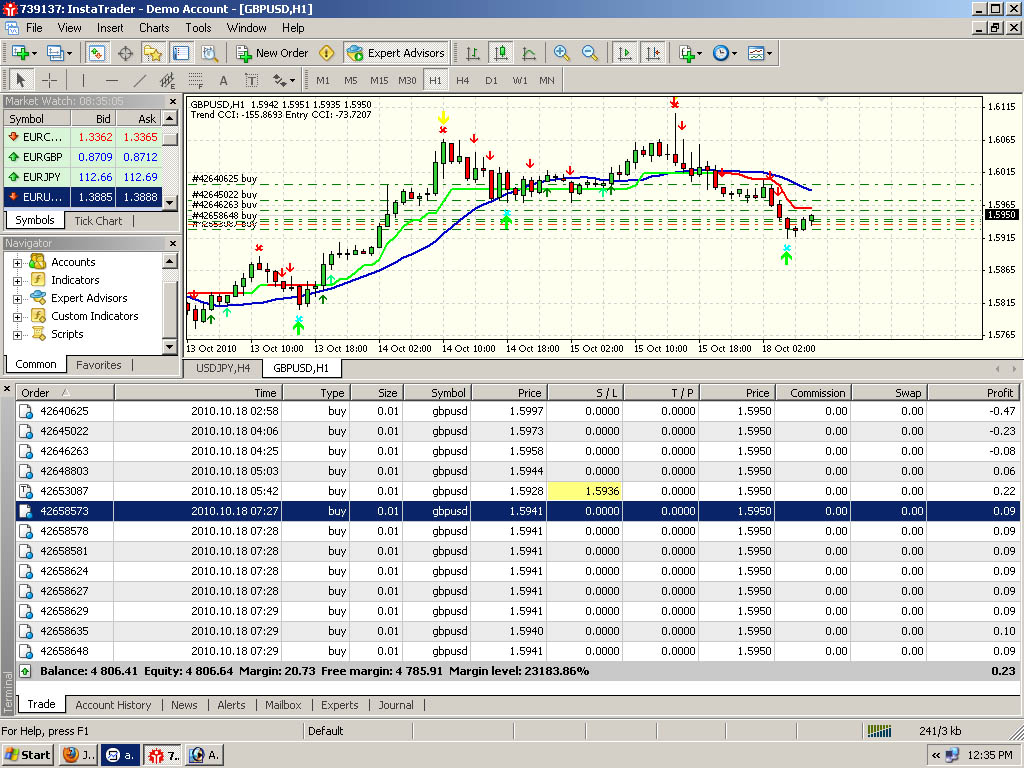

Here are some information and key points about forex trading that is often overlooked by many websites. Analysis Applications for foreign exchange trading trading software There are a number of analytical applications that make it possible to study both technical and fundamental conditions in financial markets. See our recommendations here. The best program on the market is enough Metatrader. The program is offered primarily only via online brokers, and then usually at a price that is embedded in the cost of your client.

Here you will find a wide range of currency pairs. In addition, you can trade CFDs in oil, gold and other commodities.

Other good trading software is WinTrader that the system is used only in easyMarkets. It is that I use and am very satisfied.

Here I can trade CFDs, OJ, stocks, currencies, commodities and indices. This is the most complete trading solution I know of, and there are no fees or commissions! Beginner forex trading may be a desire for a simpler software. It is easy to get lost in features that not even the pros use. Then AvaTrade spot on. Via their online trading offer, you can easily trade in Forex, and if you want some extra functionality, you can download AvaTrade's desktop applications.

Risk management Forex trading is risky, but can also provide huge profits. It's actually pretty easy to begin with foreign exchange trading. Currencies is something you can use as cash position term speculation or one can engage in active trading in foreign currency short-term trading. If you save on high interest account in Norway, it is common for people to save in Norwegian kroner.

Savings in the bank means more than just get interest on their money, it also means that you save in a specific currency - in this case, the Norwegian krone.

If one has faith in the Norwegian krone, it's not wrong to save the bank. However, if one is worried about the future prospects of the currency it saves in, so it's a bad sign. Icelanders who spared Icelandic crowns on high-interest account during the financial crisis of would have done it differently today. When we compare the value of currencies, they must be viewed in relation to each other.

At one time you can get 5. Money is not worth more than what it represents. A single dollar bill is physically the same today as tomorrow, but the value that this represents is in constant change.

The paper itself has no value, that's what the money represents real value. How to earn foreign exchange? So we come to an important question: How do you earn money on currency trading?

Trading Platforms | Forex Trading Platforms | FX Platforms | sanapidyqel.web.fc2.com UK

It is easy to understand what is required to make money on currency trading. Something else is there to try to make money in various currencies in practice. A currency pairs, such as USDNOK will never have a constant value.

The exchange rate is constantly all the time. The challenge is thus to predict the exchange rate is going to appreciate within a given period of time. If you want to speculate about long-term USDNOK, you must have an idea about which of the two currencies USD and NOK is going to appreciate.

Do you think the USD will be worth more than NOK in the future, so all you USD, NOK. As you can see, a foreign exchange transaction involves a simultaneous purchase and sale. You buy a currency, in exchange for another. ON the way is not unlike foreign exchange trading.

Switching only two "things". In stock trading money exchanged for shares. In currency trading money replaced by a currency eg NOK against the money of another currency eg USD. You earn money on currency trading that is by buying a currency that appreciates in value relative to another currency. Which currency is profitable to buy? Then we come to an even larger question: What currencies are profitable to buy and sell?

In order to give good predictions on the future exchange rates, one must analyze. There are roughly divided into two forms of analysis: Technical analysis involves studying the historical development of exchange rates.

Learn To Trade The Market » Professional Trading Education

We look at the exchange rate back in time to say something about the exchange rates in the future. In financial markets, this form of analysis is very widespread, but has its weaknesses.

It is not possible to predict the future on the basis of the past.

Nevertheless, technical analysis shows that it very often is a connection between history and current rates. Fundamental analysis is to study the market conditions.

This goes on the macro economy.

Forex Trading: A VERY Good FOREX Trading Video So TAKE NOTESThis analysis method is often far more komlisert and analysis requires more extensive work. We look at a whole range of factors that can affect exchange rates, so nypubliserte statistical reports such as unemployment eller consumer, political decisions such as interest rates, and so on.

Which form of analysis you choose will be up to you. Do you use a good currency broker, you will get all the tools dy need, and you can choose whether to engage in trading based on technical analysis or fundamental trading.

Where can I get started with forex trading? Personally, I think easyMarkets is the best currency trading. Here you get all the tools you need to engage in technical analysis.

Over the years I have tried many currency brokers, and there are many good, but even more bad. Here on my website I refer to only those I have good experience with. How to earn money in Forex Here is a genuine offer for those who want to know how you can start making money immediately. The potential for you to earn lots of money on this is very much present. Much is written about making money on the internet, mostly rubbish: This article written solely to dilute the bad advice with something that can be truly brilliant.

Of all the ways to make money on the internet, trading and investments in financial markets the most interesting. Do not get blown away if this sounds scary. If you really are out to make money, should pay close attention now Earn free money now Trading in shares, currencies, commodities and indices can be learned, and it's easy to begin with this.

The risk is limited to the money to shoot into. The online broker I use has even posted an offer to give dollars free to anyone who signs up during this month.

This is a golden opportunity to find out if this is something for you. My online broker is easyMarkets, this is my opinion the best solution for trading CFDs, stocks, currencies, commodities and indices. Margin trading is the real key to getting rich quickly, but it can also be the road to ruin.

To succeed in trading on margin, it is important to have knowledge of what we should mention here. Trading on margin means that you can hold positions much larger than what your bankroll dictates. For example, you can buy the CFD contracts in foreign currency worth NOK 50, with only 1, crowns. Here are some key concepts to understand margin trading: Maintenance Margin Maintenance Margin is the amount you must have available on your client at your service broker.

If you are giving a margin position open, you must be sure that your balance on your account is not lower than the requirement for maintenance margin. Your online broker will provide information on what the maintenance margin requirement is for every trade you make up margin. It is also important to note that there usually are different requirements for maintenance margins depending on the financial instrument to act in.

Maintenance Margin requirements for CFD trading may be very different from trading in shares, currencies or in the ETF business. Start Margin Start the margin requirement is the account balance for you to open a new position. Online brokers have different margin requirements for starting, and you should familiarize yourself with the requirements that apply at your online broker before you start with margin trading.

Margin call If you are holding an open position, and the balance is below the minimum maintenance margin, your online broker to make a forced sale - a margin call - and thus closing your position. Example of margin call: You have dollars on your client. So you decide to purchase one ten CFD contracts for Coca Cola to million. You need million in the balance on your account to hold the position open.

If your position falls below this level, close it. English Select language Contact us. Leveraged trading may not be suitable for all investors, so please ensure you fully understand the risks involved and seek independent advice if necessary.