Gift stock options charity

Absolutely, and you get a deduction for the FMV at the date of contribution. You will also avoid Capital Gains tax if you donate the appreciated stock, directly assuming it has depreciated. This is a better strategy than selling the stock and contributing the cash. This is assuming a gain. If you had a loss, then you want to sell the stock, take the Capital Loss, offset your Capital Gains, and contribute the cash. Hope this helps and Happy Holidays.

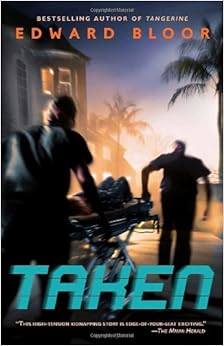

Giving Away Your Employee Stock Options

But under most situations, the answer is yes, and the above strategy applies. Many c 3 charities will accept appreciated stock as a donation. You can then donate the cash. If the stock happens to be held in an individual retirement account, you can also sell it first, donate the cash and it will not have to be reported as taxable income on your tax return. One of the best ways to give to charity is through highly appreciated stock. Here is how this works:.

Contact the charity where you would like your donation to go.

Most will have a brokerage account set up with one of the larger brokerage firms. They will give you wiring instructions to have the stock transferred. You will want to make sure that your brokerage firm knows that you DO NOT want to sell the stock, but are wanting to "transfer in kind" to the charity. That way, the charity can sell the stock and use the funds for the charitable purpose without having to pay any taxes on the gain.

Now, if you have a stock that has a built in loss, do not give this "in kind.

Charitable Planning for Employee Stock Options and Optioned Stock | Planned Giving Design Center

Giving stock is one of the best ways to support great causes and use the tax code to your advantage! Giving stock, instead of cash, as a donation can greatly benefit both parties. You will find that most charities, hospitals, schools and other nonprofit organizations will accept stock as a gift or donation.

If the stock has gift stock options charity in value from the time of purchase, the owner can avoid paying the capital gains tax by donating the security to stock market shareware party. When the security is being donated to a charitable organization, the total amount will still be eligible for a tax deduction.

Since taxation is avoided on the stock donation, the giver will be able to make a larger donation. You could either give cash or donate stock. For additional information on how to give stock as a gift, read Can I give stock as a gift?

The short answer is yes. I suggest you discuss the gift with your tax advisor, since there a few issues to be aware of such as the charity should be a qualified charity, how much will be eligible for deduction, and the impact on your taxes.

There are many different ways to give under many different scenarios based on what you want to accomplish. I suggest you carefully commodity futures trading commission attorneys what you want to achieve and under what circumstances the charity can use the funds for a specific cause, and not administrative overhead, etc. Gifting is very personal and you can accomplish or move forward some very great causes with your donation, no matter its size.

Uber CEO Travis Kalanick Resigns Goldman Sachs: Stock Picks for a New Era. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You. Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Most Helpful Most Recent. Stewart, Dan Dallas, TX. Free Consultation Was this answer helpful? Troyano, Robert Saddle Brook, NJ. Hardy, Chris Suwanee, GA.

Here is how this works: Investopedia New York, NY.

Investopedia does not provide tax, investment, or financial services. The information is not meant to be, and should not be construed as advice or used for investment purposes. While Investopedia may edit questions provided by users for grammar, punctuation, profanity, and question title length, Investopedia is not involved in the questions and answers between advisors and users, does not endorse any particular financial advisor that provides answers via the service, and is not responsible for any claims made by any advisor.

Investopedia is not endorsed by or affiliated with FINRA or any other financial regulatory authority, agency, or association. All Rights Reserved Terms Of Use Privacy Policy.