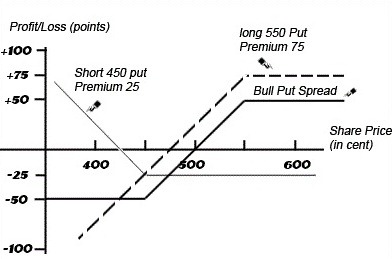

Option strategy payoff diagram

The Options Strategy Evaluation Tool OSET is Excel-based options analysis software for the evaluation of options trading strategies -- including the evaluation of follow-up strategies when things may not have turned out as planned. The Options Strategy Evaluation Tool OSET lets you construct and evaluate various strategies made up of combinations of trades in puts and calls plus trades in the underlying asset.

Four types of options are handled: See FAQ for details. Options can be declared as being of American or European -style exercise. Dividends paid on the underlying asset can be specified as being discrete up to four individual payments, each consisting of an amount and an ex-dividend date or as continuous yield pa. You then use the tool to show, graphically using a pay-off diagram or in tabular form, the impact on your profit potential of changes in the underlying price, volatility, and time.

Other features of OSET include comparative pay-off diagrams, probability analysis, break-even analysis, automatic position hedging, backtesting, time and volatility modelling, access to real-time option chains and quotes, early exercise analysis, and more. Run on-line guided tour 8.

Payoff Diagram Spreadsheet Download

This picture is an example of a pay-off diagram from the Options Strategy Evaluation Tool. The pay-off diagram makes it easy to see how time decay impacts your strategies by letting you decrease the time from deal date to expiration to the point where, at expiration, the time line bottom line in the example above merges with the pay-off line.

You can vary the time to expiration by selecting a specific date, or by changing the time remaining a day at a time. You can also get OSET to automatically cycle though the days to expiration thus producing an animated picture of the effects of time decay.

To enable better viewing of complex 'surfaces' the diagrams can be dynamically rotated both horizontally and vertically using spin buttons on the right of the above picture.

The "Greeks" can be shown in the same way. The profit if the strategy is closed prior to expiry can optionally be displayed for five dates time slices simultaneously on the payoff diagram.

The impact of volatility changes after the deal has been entered into but prior to expiry can then be dynamically modelled by clicking a spin button. The results are shown graphically, as above, and also in table form.

In the tables the original strategy, the adjusted strategy, and the difference between them ie the volatility impact are shown next to each other for each of the five discrete dates to expiry. Negative impacts are shown in red thereby making it easy to see the impacts of changes in volatility on volatility-sensitive strategies such as calendar spreads and strangles. A breakeven analysis is produced for each of the five time-slices showing all breakeven points and the probabilities of falling within the breakeven bands.

The impact of future changes in volatility on the breakeven points can be dynamically modelled. Time and volatility modelling and breakeven analysis are premium features, requiring version 9. The options analysis tool enables you to perform "what if" scenario analyses by comparing two strategies, displayed in different colours, on the same pay-off diagram, like in the following example:.

The strategies compared can be for the same or different underlying assets. If the underlying assets, and hence the underlying asset prices are not related to each other, the tool will still let you compare the two strategies in a meaningful way by representing the underlying asset price as percent change from current price.

The impact of using different calculation models Black-Scholes or Binomial and different exercise styles American or European can also be observed by displaying two versions of the same strategy, but with different calculation models and exercise styles, on the same pay-off diagram.

A slider-bar "control panel" lets you dynamically vary volatility, spot, strikes, time to expiration etc. The "position Greeks" provide essential information for traders who, for example, want to maintain a delta neutral position to hedge an entire portfolio. The Greeks can be viewed in tabular form or graphically for any range of underlying stock prices. You can view the impact of time decay on the "Greeks" by changing the time to expiration a day at a time, by specifying a specific date, or by getting the options analysis tool to automatically cycle through the time to expiration.

With the premium version of OSET Greeks can be also be produced as 3D charts, which show position Greeks simultaneously by underlying price and time to expiry as per the example above of theta for a bear spread. As for the 3D payoff diagrams, the 3D Greek diagrams can also be dynamically rotated with spin buttons using the controls you see on the right if the picture.

Position "Greeks", or hedge parameters, can optionally be superimposed on the pay-off diagram. Similarly for the other "Greeks". A pop-up control panel lets you adjust your holdings in the underlying or in one or more options trades to achieve neutrality with respect to delta, delta and gamma, vega, delta and vega, or delta, gamma and vega simultaneously.

You simply select the type of hedging required delta, vega, delta-gamma In effect it enables you to take "standard" strategies like bull spreads, butterflies and strangles, and to turn them into strategies tailored to your specific risk objectives and your view of the market. For instance if you believe, because of an impending major company announcement, that volatility is likely to sharply increase but the underlying stock could go either way depending on whether the news is good or bad then using this technique you could ensure that current positions are adjusted to be delta and gamma neutral thereby removing the stock price risk and allowing you to profit from the expected volatility increase.

The pop-up control panel lets you dynamically examine various alternatives to achieving the same neutral outcome, something which is virtually impossible to do manually. As adjustments are made they are instantly reflected on the payoff diagram so you can see the impact on profitability. Once alternatives have been explored you can then either revert to the original strategy or retain the newly hedged position. View demo on automatic 2 hour do binary options brokers make money hedging.

The option analysis tool allows you to backtest any past a strategy by stepping through the strategy from deal date to expiry using actual market data. Data requirements for backtesting are very flexible: Backtesting can either use underlying asset price history data only or it can use option history data for some or all of the past dates if available.

The 3 Big Reasons Why Your Option Strategy Payoff Diagram Is Different Today Than At Expiration

If underlying data only is used OSET will calculate option values at each step using the underlying asset price at that step. If option values are provided it will use these instead. Underlying price data can be automatically retrieved from Yahoo Finance, imported from a simple text file both underlying and option dataor simply pasted into the data sheet. Backtesting can be conducted "one step at a time" or automatically where it will go through all dates from deal date to expiry and save the results on a worksheet for later analysis.

At each backtesting step all tables and charts are dynamically updated to reflect profit realized to date. View demo on Backtesting. OSET contains most of the standard option strategy payoff diagram These act as templates for evaluating common strategies. However the 4xp technical analysis in binary options review is not in any way limited to these standard strategies and you can construct, and save, any strategy out of the basic building blocks of buying and selling puts and calls, and buying or selling the binary options using forexpros stock.

What is forex trading sunday probability of maximum loss with your call? What is the chance of not ending up between the two earn cash paypal points of your strangle at expiry? Is the probability of maximum profit larger or smaller than the probability of maximum loss with your bull spread?

The answers to the above types of questions are how to buy money on tdu2 fundamental importance in managing risk.

To help you understand your exposures and the likelihood of strategy success the Options Strategy Evaluation Tool provides a detailed analysis of "end of period" and "at any time during the period" underlying asset probabilities for each strategy. The analysis can be viewed in tabular form, and graphically. In graphical form the probabilities for a range of underlying asset prices are superimposed on the payoff diagram stock market portfolio neopets the strategy.

Slider controls for "what if" analysis let you dynamically view the impact of making changes to key variables, such as volatility, underlying asset price, and interest rate on all probabilities.

An integrated probability calculator can be used to estimate probabilities involving target ranges -- such as the probability of moving outside the breakeven points for a straddle at any time prior to expiration of the deal particularly relevant for options with American exercise. Discrete dividends paid during the life of the option, which can greatly affect probabilities, are taken into account.

Changes in key variables volatility, dividend yields etc.

Probability cones provide an effective way of understanding the complex relationships between maturity, volatility, interest rates and dividend yields and their impact on breakeven points, and as such are an important tool for strategy selection.

Maximum profit, maximum loss, and "static" returns ie assuming spot remains unchanged are calculated by strategy. In addition these numbers can also be calculated for any user-selected target price at expiry.

In the case of strategies involving holding or shorting the underlying asset, dividends received or paid are included in returns and the ROI calculations take account of the timing of dividend cash flows. You can therefore see at a glance the real returns you would get from, say, writing a covered call on a dividend-paying stock for the following situations: The Options Strategy Evaluation Tool lets you specify one volatility covering all options for a particular underlying asset.

This is often sufficient for strategy evaluation purposes. These volatilities are saved along with each strategy. For American options, which can be exercised at any time prior to maturity, the tool will produce a report listing, for each option trade in a strategy, the underlying asset prices and dates at which early exercise could be optimal.

The probability of reaching each early exercise threshold is also shown.

The report can be used to highlight the risks for option writers and the opportunities for option holders of early exercise. Data for option trades can be entered manually. However the Options Strategy Evaluation Tool will also retrieve on-line option chains from a number of data sources and options can be selected from the list of available options by a simple point and click.

A "suggest" button will automatically map a generic strategy eg a strangle to actual option trades available in the option chain. This greatly speeds up the process of trade selection and comparison of multiple strategies compared with manual data entry. Take the on-line tutorial for more details. The prices of all options, and the underlying asset, in a strategy can be updated from on-line data at any time by one click of the mouse.

Option chains can also be imported from a simple comma delimited text file if you have access to data from providers not explicitly handled by the software. As well as providing a simple way of selecting options, the option chain facility also lets you compare, for a given option, spread or combination, the impact on profit and loss of increasing or deceasing strikes for a given expiry date, moving to different expiry dates for a given set of strikes, or both.

The 3 Big Reasons Why Your Option Strategy Payoff Diagram Is Different Today Than At Expiration

One button click moves the current strategy to the next or previous strike combination or expiry date. On-line option chains are also used to produce a number of "sentiment indicators": On-line access to option chains is a premium featurerequiring the full version of the Hoadley Finance Add-in for Excel. For more information on the exchanges and data sources supported, see On-Line Data.

For detailed systems requirements, including supported versions of Windows and Excel see systems requirements. View feature highlights for a summary of key features. FAQ page for how to use the software and other aspects of its operation. Once the software application has been installed on your hard drive you can construct, and save, your own strategies without limit.

The Options Strategy Evaluation Tool is a turnkey application. It is password protected and cannot be changed. To help you learn how to use OSET there is a brief " how to use the tool " section in the FAQs and on-line demos and tutorials which provide a general overview of the main functions plus some detailed guidance for using some of the more advanced features of the tool.

The Options Strategy Evaluation Tool OSET is free to download. If you don't also have the Hoadley Finance Add-in for Excel on your PC then the basic version of OSET is what you will get.

If you also install the full version of the Hoadley Finance Add-in for Excel on your PC either before or after installing OSETthe premium features in the Options Strategy Evaluation Tool will be automatically enabled. There is no need to download OSET again -- your basic version of OSET will be automatically converted to the premium version as soon as it detects that the Finance Add-in for Excel has been installed on your PC.

The premium version of OSET is a major step up from the basic version in terms of power and ease of use. See premium features for details. The Hoadley Finance Add-in for Excel also includes these options applications and portfolio analysis and design applications.

Hoadley Finance Add-in for Excel: Cost and on-line purchase. Home Search Hoadley Site. Overview Price List Buy now Login - Existing Users. General Enquiries Commercial License Enquiries. Overview Feature Highlights Premium Features. Without Dividends With Dividends. Value at Risk VaR Portfolio Analysis, Asset Allocation. Options Strategy Evaluation Tool Options Analysis Software Options Strategy Analysis. Model time and volatility. View "Greeks" for Individual Trades and for Net Strategy Position.

The calculator takes account of the calculation model used Black-Scholes, Binomial American The historic volatility calculator also lets you 'model' the volatility smile for each underlying asset so implied volatility can be more closely calibrated to observed market prices.

To use the historic volatility features the full version of the Hoadley Finance Add-in for Excel needs to be installed on your PC.