Stock market deregulation

Politicians and central banks embarked on a broad process of national-level reform and international coordination — all intended to reduce the chance that very large banks could collapse. A decade later, the global financial system has in some ways become safer as a result of these efforts. In other ways, however, the structure has not changed much — and may even have become more vulnerable.

But, instead of completing the reform process, policy makers on both sides of the Atlantic seem determined to undo most of the measures underpinning what progress has been achieved. Trump and Cohn are wrong: The past decade has yielded three main accomplishments.

Deregulation

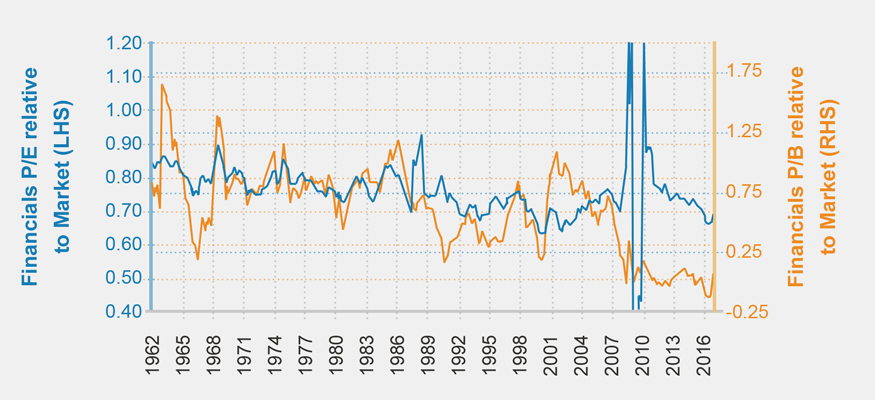

First, some financial firms failed, and for good reason: At the same time, stronger financial firms expanded their market share. Second, the funding of banks shifted away from debt and toward equity.

That does not happen today. Third, there are now restrictions on the activities of the largest banks. The so-called Volcker Rule prevents proprietary trading — a form of in-house speculation — by United States-based banks. In other countries, bank supervisors have become more skeptical about supposedly sophisticated risk-taking.

Caution is in the air. Unfortunately, all of these achievements may prove ephemeral. Powerful people want to remove restrictions on banks in the U.

For example, the Volcker Rule can be expected to come under great pressure from Goldman Sachs and its many alumni now serving in senior U. This is exactly what happened in the early s. If Cohn gets his way, the consequences will be similar: Since , the global financial system has become more concentrated in important ways.

Finance sometimes seems complicated, but what is at stake is quite straightforward. Rhode Island Democratic Sen. Jack Reed recently summed it up well: There is a value and a benefit to protecting consumers and their hard-earned wages. And there is a value and a benefit to keeping a family in their home and avoiding foreclosure.

If someone was dramatically hurt by a financial crisis, that person is less likely to want to go through the same thing again. But if someone did really well — by buying assets on the cheap at the bottom of the cycle, for example, or expanding market share — it seems reasonable to suppose that they are less likely to favor caution.

Reed made precisely this point in speaking to the suitability of Steve Mnuchin — a former Goldman Sachs executive vice president — as Treasury secretary:.

Based on his record, I am not convinced Mr. But the Senate confirmed Mnuchin, which suggests that we are about to come full circle. The reforms were serious; but they did not go far enough, and they can be rolled back without much difficulty. The big banks will get bigger. Capital levels will fall. And reasonable risk-management practices will again become unfashionable.

Powerful people do well from booms and busts. The rest of us can expect deeper inequality and more crisis-induced poverty. This article has been published with the permission of Project Syndicate — The Financial Fire Next Time.

Simon Johnson, a former chief economist of the IMF, is a professor at MIT Sloan, a senior fellow at the Peterson Institute for International Economics, and co-founder of a leading economics blog, The Baseline Scenario. He is the co-author of "White House Burning: The Founding Fathers, Our National Debt, and Why It Matters to You. By using this site you agree to the Terms of Service , Privacy Policy , and Cookie Policy. Intraday Data provided by SIX Financial Information and subject to terms of use.

Historical and current end-of-day data provided by SIX Financial Information. All quotes are in local exchange time. Real-time last sale data for U.

What Is Market Deregulation? | sanapidyqel.web.fc2.com

Intraday data delayed at least 15 minutes or per exchange requirements. ET Winnebago profit and sales rise more than expected, boosted by Grand Design acquisition.

Deregulation and the Financial Crisis | HuffPost

Winnebago Q3 EPS 61 cents vs. Why Your Next Car May Look Like a Living Room. Updated Brexit one year after vote: Here are the 5 possible scenarios for the EU divorce. Intel's stock drops 1. AMD's stock surges 1. Queen's Speech had no mention of President Trump's state visit.

Government will implement Paris Climate Agreement. Why Grubhub Could Be Amazon's Next Takeout Target. Home News Viewer Video SectorWatch Podcasts First Take Games Portfolio My MarketWatch. Retirement Retire Here, Not There Encore Taxes How-to Guides Social Security Estate Planning Events Columns Robert Powell's Retirement Portfolio Andrea Coombes's Working Retirement Tools Retirement Planner How long will my money last?

Economy Federal Reserve Capitol Report Economic Report Columns Darrell Delamaide Rex Nutting Tools Economic Calendar. My MarketWatch Watchlist Alerts Games Log In. Until New York Markets Open Market Snapshot Analyst Ratings.

By Simon Johnson Columnist. Stock market closes lower as oil slips into bear-market territory. Related Topics Economics U. Economy Markets Europe U. We Want to Hear from You Join the conversation Comment. MarketWatch Site Index Topics Help Feedback Newsroom Roster Media Archive Premium Products Mobile. Dow Jones Network WSJ.