Explain the role of sebi in primary market

The Securities and Exchange Board of India, SEBI, is the government agency that monitors and regulates all securities-trading activity in the country's markets.

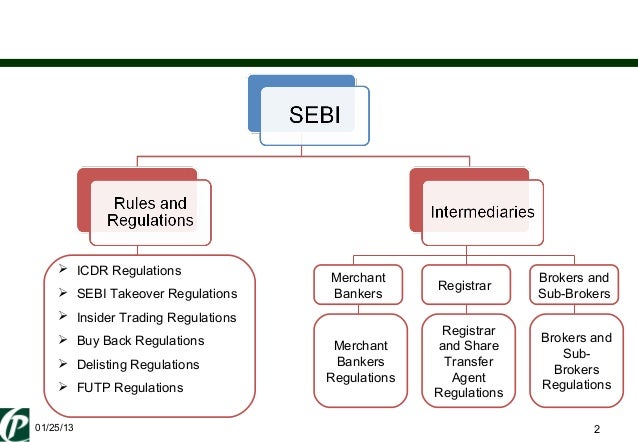

The primary market in India, like that in other countries, is the market on which investors and companies trade stocks, options and other public financial instruments. In , SEBI issued a set of guidelines for the primary market that covers 17 consumer and investor protection areas, including how new companies become active on the primary market and how they issue and price securities. The guidelines also cover how banks can issue capital to new companies, as well as how banks can issue debt instruments as investments.

Indian companies that want to open their operations to public funding must work through a broker who is licensed with SEBI to offer and accept applications for funding through India's e-IPO system, which is an online system for bringing private companies to the primary market.

The broker must work with a registrar from the company to negotiate all offers between the company and potential investors. In conjunction with the company's leadership, the broker must make all investment information available in Hindi as well as English, and must include a time frame for each offer and accepted modes of payment.

The broker must keep all funds pertaining to the IPO in an escrow account and must report daily to the company's registrar. SEBI licenses brokers in order to keep unscrupulous people from taking advantage of unsuspecting companies and investors.

A company must file a draft prospectus with SEBI at least three weeks before filing its final documentation with the Registrar of Companies on the primary market. The draft prospectus contains contact information for the company, an analysis of market risks and how the company will respond to them, as well as information about the company's leadership.

After the company is registered and approved, it can freely determine the price at which it wants to list its shares on the primary market. If a bank is involved in listing a company, the pricing of its shares must be approved by SEBI. The company must make public the face value of all publicly traded shares.

Companies and banks that include debt instruments as part of an investment offering must disclose credit ratings to SEBI before entering into any agreements with investors. Debt instruments are statements in which the issuer raises capital by selling debt to an investor.

The issuer pays back the investor with interest according to the terms of a contract. SEBI requires that all companies issuing debt instruments keep their investors informed by providing cash flow and liquidity information. SEBI allows companies to choose to repay their debts by issuing stock or other financial instruments to those invested in the company's debt. SEBI does not limit the amount of capital a financial institution can issue to a publicly traded company, though it does not permit institutions with a conflict of interest to issue capital to a company.

Designated financial institutions, those that are approved by SEBI, reserve a percentage of the company in which they want to invest and are entitled to hold that percentage for three years. Should the financial institution release part of its reservation, those shares will become part of the publicly available shares.

SEBI also allows institutional investors to valuate their holdings in a company as they see fit, providing the institution has shown a profit over the past three years.

SEBI Guidelines for the Primary Market.

NEWS ON AIR : News On AIR brings the Latest & Top Breaking News on Politics, G summit, Cricket, Sports, Business , State,Formula One in INDIA , Regional Language Audio Bulletins , Regional Language scripts & more..

Share Share on Facebook. SEBI regulations govern how public companies can raise money from investors. McDonald's Is Now Hiring People Via Snapchat Investing.

Can You Guess the Richest County in America?

GK Syllabus, Tips and Books( For All Bank Exams, SBI CLERK, NABARD)- Bankers Adda

How to Pay Our Student Loan Debt Off Faster or Not At All. How to Compare Stock Prices Investing.

What Happens After a Stock Trade Is Filled? How to Make Money by Jobbing in the Stock Market Investing. Please enter a valid email.