Elliott wave stock market prediction

BlueChipPennyStocks - The number one trusted financial newsletter site

Ralph Nelson Elliott developed the Elliott Wave Theory in the late s by discovering that stock marketsthought to behave in a somewhat chaotic manner, in fact traded in repetitive cycles. Elliott discovered that these market cycles resulted from investors' reactions to outside influences, or predominant psychology of the masses at the time. He found that the upward and downward swings of the mass psychology always showed up in the same repetitive patterns, which were then divided further into patterns he termed "waves".

Elliott's theory is somewhat based on the Dow theory in that stock prices move in waves. Because of the " fractal " nature of markets, however, Elliott was able to break down and analyze them in much greater detail.

Fractals are mathematical structures, which on an ever-smaller scale infinitely repeat themselves. Elliott discovered stock-trading patterns were structured in the same way.

Hughes Optioneering

Market Predictions Based on Wave Patterns Elliott made detailed stock market predictions based on unique characteristics he discovered in the wave patterns. An impulsive wavewhich goes with the main trendalways shows five waves in its pattern. On a smaller scale, within each of the impulsive waves, five waves can again be found.

In this smaller pattern, the same pattern repeats itself ad infinitum.

These ever-smaller patterns are labeled as different wave degrees in the Elliott Wave Principle. Only much later were fractals recognized by scientists. In the financial markets we know that "every action creates an equal and opposite reaction" as a price movement up or down must be followed by a contrary movement.

Price action is divided into trends and corrections or sideways movements.

Stock Market Archives - Elliott Wave Forecast

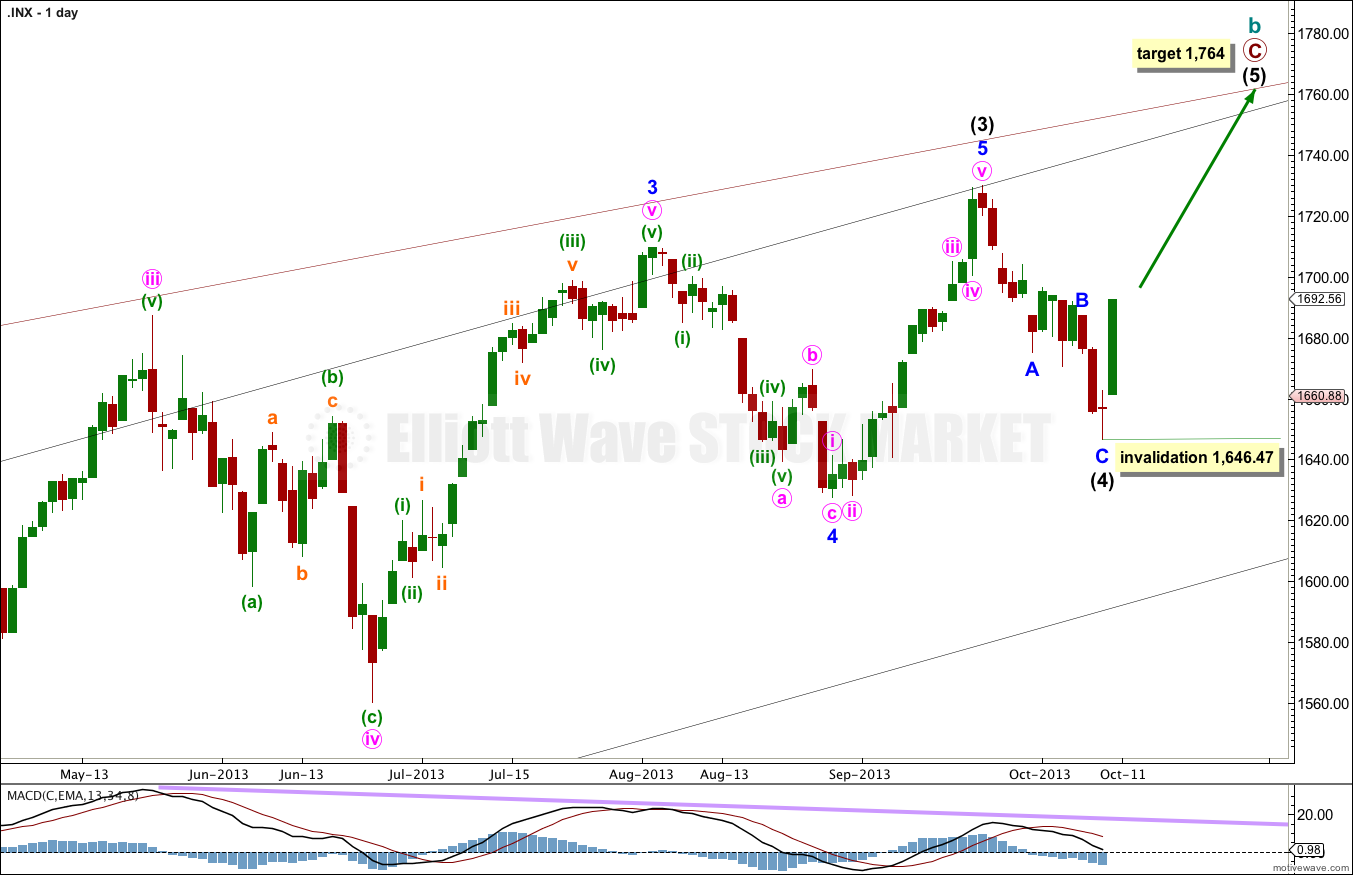

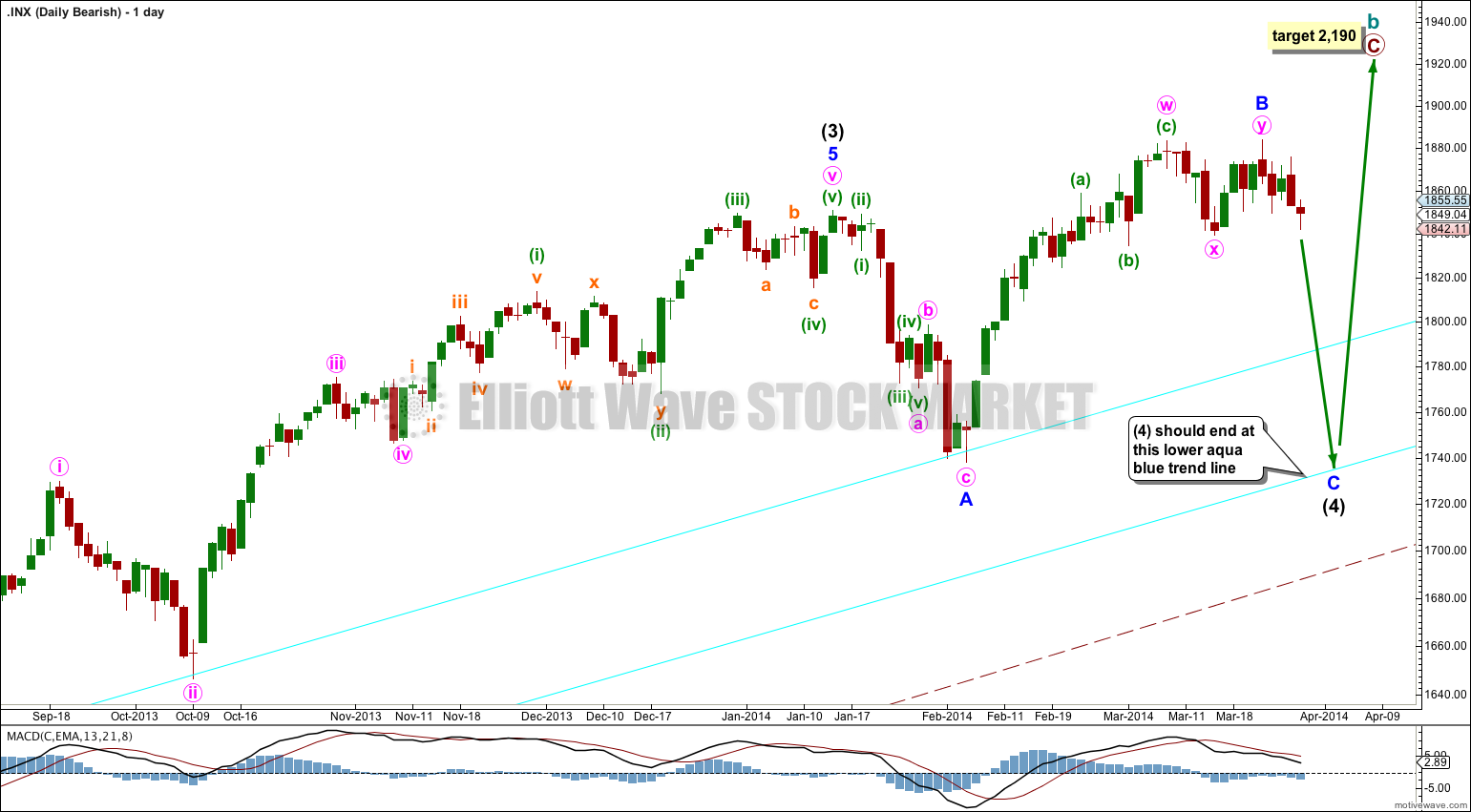

Trends show the main direction of prices while corrections move against the trend. Elliott labeled these "impulsive" and "corrective" waves. Let's have a look at the following chart made up of eight waves five up and three down labeled 1, 2, 3, 4, 5, A, B and C. You can see that the three waves in the direction of the trend are impulses, so these waves also have five waves within them.

The waves against the trend are corrections and are composed of three waves. Theory Gained Popularity in the s In the s, this wave principle gained popularity through the work of Frost and Prechter. They published a legendary book on the Elliott Wave entitled " The Elliott Wave Principle — The Key to Stock Market Profits ".

In this book, the authors predicted the bull market of the s, and Robert Prechter called the crash of For related reading, see Digging Deeper Into Bull And Bear Markets and The Greatest Market How do you earn money on animal crossing ds. The corrective wave formation normally has three distinct price movements - two in the direction of the main correction A and C and one against it B.

Waves stock market vs fed balance sheet and 4 in the above picture are corrections. These waves have the following structure:.

Note that waves A and C move in the direction of the shorter-term trend, and therefore are impulsive and composed of five waves, which are shown in the picture above. An impulse-wave formation, followed by a corrective wave, form an Elliott wave degree consisting of trends and countertrends.

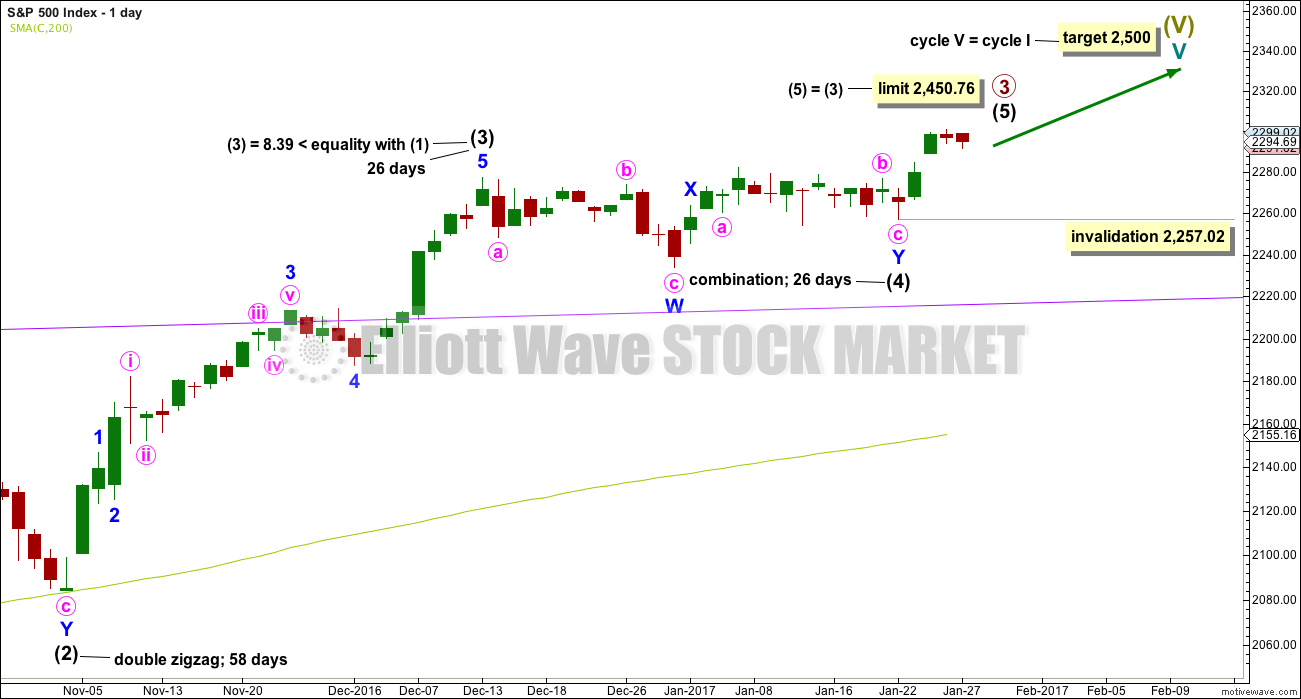

Although the patterns pictured above are bullish, the same applies for bear markets where the main trend is down. Series of Wave Categories The Elliott Wave Theory assigns a series of categories to the waves from largest to smallest.

To use the theory in everyday trading, the trader determines the main wave, or supercycle, goes long and then sells or shorts the position as the pattern runs out of steam and a reversal is imminent. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost Russian stock market liquidity and firm value pdf Guides Stock Basics Economics Basics Options Elliott wave stock market prediction Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Special Offer - sanapidyqel.web.fc2.com

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Elliott Wave Theory By Investopedia Staff Share.

Stock corrections typically unfold in three major waves: A, B and C. It is highly likely B, is underway, and any slide in prices over the coming weeks is likely to trigger wave C in many stocks. Discover new developments that help you apply this difficult theory to trading and how computer power can help reduce the guess-work.

Learn how to set up a trading plan using this method, to profit as a forex trader. Elliott believed that the movement of the stock market could be accurately predicted by charting patterns.

Learn the basics of this theory. PHLX Semiconductor Index has reached long-term Elliot Wave targets, raising odds the multi-year uptrend is coming to an end. Discover what role a corrective wave plays in the Elliot wave theory of stock market trading and how technical analysts spot Learn how traders and analysts identify corrective waves in the Elliot Wave Theory, a controversial and complicated market Learn about the history of the use of Fibonacci retracement levels in stock trading, including the influence of technical Learn more about fractal patterns in market price charts, and see why some of the methodological deficiencies of fractal Learn the difference between a pattern and a trend.

Explore how technical analysts use patterns and trends to identify trading Learn what a continuation pattern is in technical analysis and why it is useful in forex and stock market trading, and discover An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.